Superdry has announced that it is delisting from the London Stock Exchange as part of a restructuring plan designed to help the global brand recover from recent financial losses.

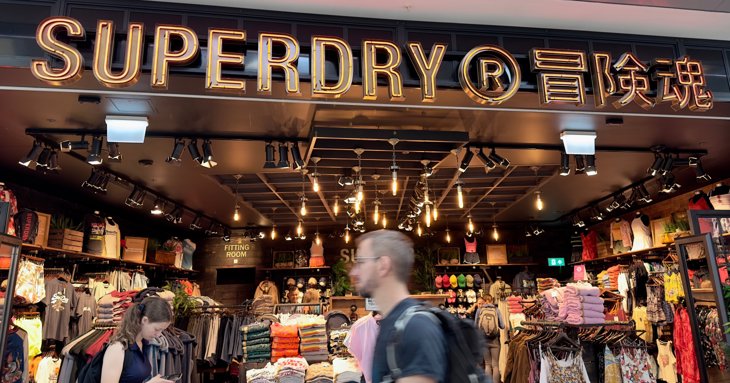

Headquartered in Cheltenham, the fashion brand, famous for its hoodies and outerwear, has over 94 locations in the UK alone, with further franchised stores across the globe.

The restructuring plan primarily involves running via a new target operating model, prompting a stock market shakeup which Superdry considers best to implement 'away from the heightened exposure of public markets.'

By delisting, Superdry also 'believes it can achieve significant annual cost savings that will contribute to delivering its target operating model.'

The brand requires approval from its shareholders before exiting, a subject that will be discussed at an upcoming general meeting, before applying to delist its shares from the Official List maintained by the Financial Conduct Authority (FCA).

The restructuring plan will also involve the compromise and amendment of Superdry's leasehold obligations, to 'reduce losses and property-related liabilities.'

Once completed, the plan will see a variety of measures aimed at cutting costs to avoid the company going into administration, including the reduction of rent on 39 UK stores, but it states that the plan is not expected to affect the ordinary operations of Superdry.

The company is also proposing an equity raise — issuing of new shares — that will provide necessary liquidity headroom as a result of it continuing to face 'challenging trading conditions'; a proposal fully supported and underwritten by its CEO and co-founder, Julian Dunkerton.

In this equity raise, shareholders will be asked to approve a pair of options, one will then be taken forward after careful consideration from Julian and Peel Hunt, Superdry's financial advisors — option A being an open offer at £0.01 per share to raise gross proceeds of the sterling equivalent of up to €8 million and option B being a placing at £0.05 per share to raise gross proceeds of £10 million.

Julian has held approximately 26.36 per cent of Superdry's issued share capital and has voted in favour of all the resolutions to be proposed at the general meeting — alongside each of Superdry's shareholding directors.

He commented on Tuesday 16 April 2024: 'Today's announcement marks a critical moment in Superdry’s history.

'At its heart, these proposals are putting the business on the right footing to secure its long-term future following a period of unprecedented challenges. I am aware of the implications for all our stakeholders and I have sought to protect their interests as much as possible in the proposals we are announcing today.

'My decision to underwrite this equity raise demonstrates my continued commitment to Superdry, its stakeholders, its suppliers and the people who work for it. My passion for this great British brand remains as strong today as it was when I founded the business.'

According to a provisional timetable, Superdry hopes to carry out proposals by July 2024.