A Cheltenham construction firm has received more than £38,000 in research and development (R&D) tax credits, thanks to the innovation it has demonstrated in its building projects.

Love2Build, founded in 2015 described the windfall as a ‘much-welcome sum of money following a rough last year’.

Previously unaware its work was eligible for the Government incentives, R&D tax specialists Access2Funding, stepped and proved its projects qualified.

Daniel Duncombe-Davis, director of Love2Build, said: ‘The terminology ‘research and development’ can make people think their business is not eligible but what I’ve learnt from Access2Funding is that as builders, a large proportion of what we do every day is R&D.

‘We’re always thinking on our feet, trying to find solutions to problems. If there’s something that’s not going to work on the plan and you are altering it with your own design input, then that could be R&D.’

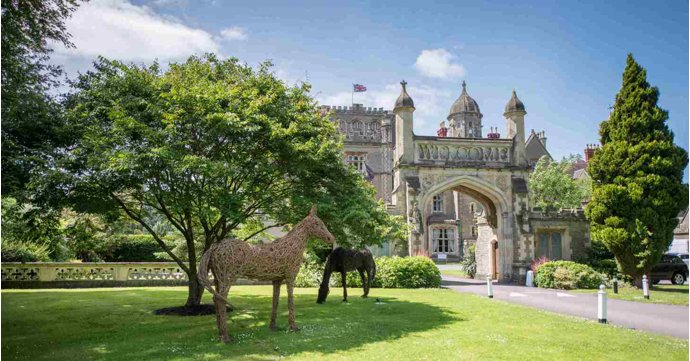

Innovative projects include extensive work done on a farm, that involved creating a new structural support when removing walls, and work carried out on a modern extension and roof terrace which allowed the aged aesthetic of the rest of the cottage to remain undisturbed.

Love2Build plans to invest the money back into the business. Plans include paying back government-backed loans, purchasing new tools and rebranding with a new logo and website.

R&D tax credits are a HMRC incentive to encourage UK businesses to continue to grow by innovating. The incentive being a reduction in corporation tax a cash payment.

If a business is seeking to resolve a scientific or technological uncertainty within its projects by creating new processes, products or services (or amending existing ones) then they could be performing R&D without realising it, according to Access2Funding.

The latest HMRC statistics show that the construction sector lags behind some other sectors when it comes to claiming such tax relief, accounting for just four per cent of all claims across the scheme, despite being one of the key sectors that innovate regularly.

By Andrew Merrell

Follow SoGlos on LinkedIn and sign-up to the weekly SoGlos business newsletter for the very latest Gloucestershire business news stories.