Rishi Sunak has had his moment in the spotlight with his second Budget on Wednesday 3 March 2021, but it is what impact that will have on business in Gloucestershire that matters – and here’s exactly what organisations across the county has told SoGlos.

This was a Chancellor still in giving mode – which speaks volumes about the distance we still have to travel as a nation and how far our economy is yet from reaching the safety of the shoreline.

But, his measures bought a welcome and sometimes tough, response from those charged with keeping their businesses alive to drive our economic recovery out of the pandemic.

Kieron Bates, chairman of Gloucester BID, which represents city centre businesses, said: ‘There are plenty of positives here – not least VAT frozen at five per cent, and that it will not go straight back up to 20 per cent when it does rise again. News the business rates holiday and the furlough scheme were to be extended is also welcome.

‘The announcements about restart grants and grant funding to support retail and the personal care sector too, which will be among the last to re-open, is also a plus.

‘There is a long way to go yet, but anything that can help Gloucester businesses get through this and get ready for reopening will help give everyone good reason to come back into Gloucester to enjoy everything the city has to offer again – and that’s what we all want to see.’

James Birt, managing director at estate agents Naylor Powell, said: ‘As a business we are very happy with the budget.

‘The extension of the stamp duty holiday to June 2021 is very welcome as is the temporary increase to the starting rate of stamp duty to £250,000 until September.

‘This is a great opportunity for first time buyers to get onto the property ladder and make some savings. I will also be very interested to see more detail about the mortgage guarantees.’

Adam Vines, vice president of Cirencester Chamber of Commerce, said: ‘Some of the policies are encouraging for small business owners, particularly the funding scheme for apprentices which will help to enable a work force for the future.

‘VAT and corporation tax initiatives also allow more breathing space for SMEs to get back on track. We are pleased to see funding opportunities and favourable loans for tourism and hospitality businesses too.’

Tony Davey, chairman of Stroud chamber of trade, welcomed the business rates holiday, VAT support for the ‘much-impacted’ tourism sector, re-start grants, extension of the furlough scheme, which he said would ‘allow many businesses to adjust according to business flow and customer confidence’.

‘The SEISS (Self-Employment Income Support Scheme) net has been cast wider for the self employed, now encompassing the newly self-employed, but there are still many small businesses and their owners that fall through the gaps.

‘The wedding industry remains disproportionately impacted and restricted – I hope to see some adjustment to this in the coming weeks.

‘We now need to see what the employment situation and consumer spending confidence is as we start to loosen restrictions.

‘Should we see continued rises in redundancy, closures and a lack of public confidence, the support measures will only go so far.

‘This said, I have great confidence in the robustness of the businesses across the district and their opportunities to thrive and succeed again, with the support of their loyal customer base.

‘I urge everyone to support their local communities and to bolster their local economy by thinking local first.’

Steve Gardner-Collins, chairman of VisitGloucestershire, which represents tourism in the county, said: ‘This Spring Budget provides a positive outlook for visitor economy businesses in the county until September.

‘The budget has focused on people and place and these are very much at the heart of tourism and hospitality.

‘The welcomed extension of the furlough scheme continues to secure many jobs for those still furloughed and will allow our accommodation, attractions, venues, pubs and restaurants to open up and balance money coming in and out.

‘New grants of up to £18,000 for hospitality venues will hopefully take away some of this ongoing strain the pandemic is having on businesses in the sector.

‘For now, we continue in uncertain times and what the sector really needs is clear certainty when employees can return to normal working patterns and a sense of positive outlook, and not a continuation of the unknown.’

Andrew Coates, owner of Cheltenham’s Sandford Park Alehouse and Bath Road Beers, and also a member of the town’s powerful independent hospitality sector collective TURF, said the standout points for him were:

The furlough extension to September, the restart grants (‘a huge boost to helping us be ready’), and the VAT support to September at five per cent and then 12.5 per cent to April on food and soft drinks was ‘great too’.

‘Holding duty is okay, but not enough to address what is already a very high rate verses the rest of Europe,’ he added.

Gareth Fulford, also of TURF and the man behind the award-winning Purslane Restaurant in Cheltenham, called the Budget ‘generally pretty positive’.

‘The extension to furlough until the end of September is welcome but also a little concerning that it may mean restrictions will not be lifted in the time frame already set out.

‘I would have liked to have seen the VAT at five per cent until the end of the year really, as there are still another two and half months before we can trade and make any use of it. I am pleased however that the rate is not going to jump straight back up to 20 per cent.

‘The restart grant is going to help the business get going again, but if restrictions are extended this must be looked at again.

‘The Chancellor’s reasoning on the value being equivalent to a year’s rent is way out. Overheads currently cost my business £5k a month even when closed.

‘So, if lockdown goes past 17 May 2021 or restrictions go past mid-June then support for the sector will still be needed.

‘The new corporation tax structure makes sense I think and is a relief that SME’s will not suffer if the profits are not there.

‘I also think the two-year super-deduction makes now a great time to invest in equipment to improve business for the long term’.

Edward Anderson, who runs The Railway, The Swan and The Vine public houses in Cheltenham, and another member of TURF, said: ‘I would have like to have seen the following… VAT cut on alcoholic drinks so that pubs can benefit and not just cafes and restaurants.

‘Also, help for those small businesses whose landlords have given them no rent concessions, there is a considerable build-up of rent debt that has built up this last year through no fault of the tenants and there is still no help with this

‘The business rates holiday is welcome, but we need a comprehensive rethink as so much business is now carried out online, it seems unfair hospitality is still due to pay high business rates in the future but these online businesses are not contributing to our society.

‘The issue of tax on alcohol and distortions of the market is another long-term problem that need addressing.

‘There need to be a commission into competition in the sector and tax in the beer and alcoholic drinks market.

‘At the moment we’re relying on laws that fit a time when beer was delivered by horses and the system increasing punishes tenant publicans and small brewers when compared to the multinationals and stops growth of independents.’

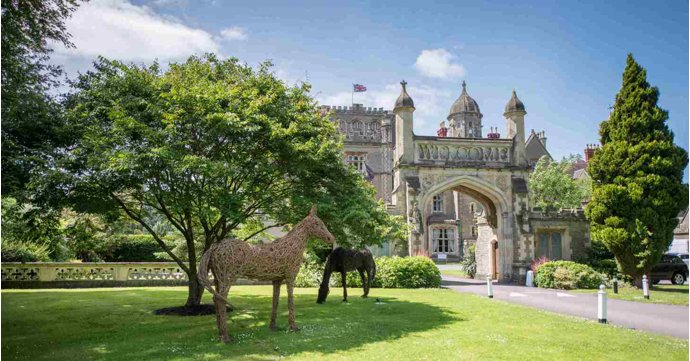

Putting it succinctly, giving everyone hope, and reflecting perhaps the general consensus out there, was Lindsey Holland of Cleeve Hill Hotel.

‘I think the budget will mean I’m hopefully home and dry – if the business bounces back. The hard work now comes to get the business back, and that’s just a national issue all over.

It’ll take some people some time to readjust to going out again,’ said Ms Holland.

At SoGlos we wish each and every one of them all the very best.

By Andrew Merrell

Follow SoGlos on LinkedIn and sign-up to the weekly SoGlos business newsletter for the very latest Gloucestershire business news stories.