A clear set of accounts is vital for anyone to understand their business, but good management information alongside can be transformative.

That doesn’t mean a ‘standard’ Excel spreadsheet for your accounts, but a customised view that is easy to understand, timely, insightful – and lays out what you need to know in a way that suits you.

Imagine how much easier and impactful your decision making would become.

About the expert – BookCheck

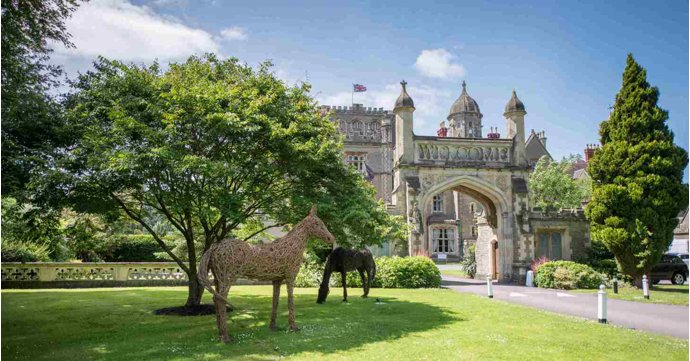

Gloucestershire based BookCheck was founded by Anthony Pilkington in 1994 and has grown to become a major force in the delivery of transformative bookkeeping with management accounts services for businesses UK wide.

What has always set BookCheck apart is the added value it offers its clients in the prompt production of quality management information, but an increasing number of businesses are also now benefiting from its ability to make their accounts digital – using the firm’s Xero Migration plus Add-on Development (MAD) service.

This workload has grown so much that a new company BookCheck Xero MAD Ltd has been formed to specialise in this subject, with Keri Baker appointed to become the general manager from January 2022.

BookCheck is thriving because of its ability with Xero or Sage bookkeeping together with management accounts. What makes its combination special?

We always refer to bookkeeping with management accounts. The proposition is very simple. Based upon top quality and reconciled bookkeeping, it’s safe and sensible to use such to produce quality management information. This is the key basis for management decisions on improving the business profitability. If you measure it, you can improve it.

Customers also migrate to BookCheck because of how it can present that management information to them. What makes that so special?

It may sound like a bit of a boast but our reporting is world class. There are various ways of reporting management accounts. Assuming an accounting system is used (most businesses just rely on Excel or even less) then the simplest method is to use the reports in Xero or Sage or whatever. This is fine for many, but there comes a point when it’s not good enough and then Excel is the most likely tool used.

But there are plenty of ways of achieving that objective. The most basic method is just keying in the information. At a level above that, data can be extracted from the accounting system and manipulated manually.

.jpg?width=730&rmode=pad&bgcolor=ffffff&quality=85)

The challenge with both these approaches is: all of the time required, the risk of errors and the difficulty. Why we are world class is because we use sophisticated software to link the Sage or Xero accounting system to Excel. It’s fully templated so it’s quick and safe, albeit in the right hands. There is nothing better.

The massive benefit of Excel is its 100 per cent flexibility in portraying the reporting exactly as required. So, we can say to our clients – if it’s in there then we can guarantee that we can report it in any way you wish – any combination of numbers, fonts, colours, graphs, comparisons, history etc…

As each report is tailored specifically to the individual user then it stands the very best chance of being understood and most importantly then being used to advantage.

Most businesspeople would use management information to inform them about sales, sales orders and what’s in the bank. What extra does good management information provide?

Most businesses know these three basics, although some don’t know what’s in the bank!

What few businesses know with any degree of certainty:

• Overhead costs and comparison with budgets or previous year(s)

• Gross profit per cent

• Profits overall

• Profit by sector of the business – this is really crucial information but is rarely reported

Suppose a business had five contracts in a year, but it didn’t measure the profit of each individually. How could it learn to improve if it couldn’t measure? The one with lots of sales might be the least profitable so should be avoided in future or made more successful. But which one is it?

Unless this is known then all the business can go on is sales which is not focussed on ultimately the most important of all objectives – higher profits. All accountants will tell you that sales is vanity and profit is sanity.

There is a testimonial on your website from one of your customers: ‘I would give you the world for that information’. Can you put that response in context?

.jpg?width=730&rmode=pad&bgcolor=ffffff&quality=85)

This was a prospective client running 16 properties. The owner was drowning under a mass of information, it was impossible to assimilate and understand. What was desperately needed was 16 profit and loss accounts, which we provided in a mock-up report. That was what caused the quote after a beautiful few seconds in realising that his problem was solved!

We are very pleased to say that they became a client 10 years ago and they remain so. During this time they’ve expanded hugely and have won a Queen’s Award for Enterprise.

BookCheck stresses it is not a firm of accountants, and simply presents clear information tailored to help managers make informed decisions with confidence. How transformative can this kind of clarity be for a business?

Every business can improve, where we come in is to boost the profitability. This applies whatever the size of business. It’s really down to the basic level – if you can measure the components in detail and be confident in the numbers, then you can focus on improving each element.

For instance, by looking at all the overheads and considering how the significant values can be reduced. Comparing with the previous period is a useful way of sizing the situation. Perhaps set a target of reducing the total cost by 10 per cent which would go straight onto the bottom-line profit.

.jpg?width=730&rmode=pad&bgcolor=ffffff&quality=85)

A key metric to check is the gross profit margin i.e. what per cent of the sales price is profit after the product or service cost. Then aim to improve it by say two to five per cent. If your sales are £200,000 then your net profit would increase by £4,000 to £10,000. Achieve this by raising prices or lowering costs or both.

Having produced the management information, the trick then is for the decision maker to understand the numbers, to ‘own’ them. This is not difficult to achieve, it’s simply a matter of the user discussing the reporting and the information being crafted to their understanding. Then the magic starts…